How Technology is Disrupting Traditional Venture Capital Management Models

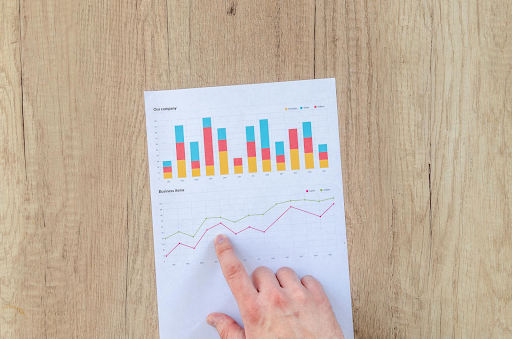

Venture capital has traditionally thrived on personal connections and the gut feelings of seasoned investors. This old-school method was once effective but is now becoming less relevant as new technologies transform how investments are managed. With projections indicating that the global venture capital market will amass a notable $468.4 billion in 2024, there is a growing need for investment firms to adopt innovative technologies urgently.

The increase in available funds is sparking a move towards digital solutions that improve how deals are found, simplify management tasks, and support better strategic decisions. As we approach this significant change, venture capital is set to undergo substantial transformations, propelled by the adoption of sophisticated digital tools and data analysis in its fundamental operations.

Venture Capital CRM: Leading the Charge in Technological Adoption

Venture capital firms are now embracing customer relationship management (CRM) systems designed just for them. These tools are transforming how VCs handle their contacts and manage deals.

By automating the gathering and analyzing of data, a venture capital CRM gives VCs quick access to precise investment details. This cuts down on manual data entry and lets them focus more on making strategic choices. As a result, the investment process becomes faster, and interactions with potential investment targets improve.

Big Data and Predictive Analytics

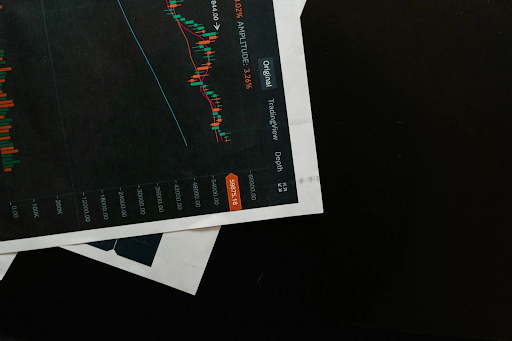

Venture capitalists are now relying more on big data and predictive analytics to spot new trends and attractive investment options. Shifting from gut feelings to data-based choices, they can uncover trends and details that were once hidden by the overwhelming amount of data or human analysis limits.

These tools help investors more precisely predict startup successes and make smarter choices on where to invest their money, aiming for better financial outcomes.

Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning are making significant inroads into venture capital by streamlining the due diligence and market analysis processes. These technologies evaluate the potential of business plans and forecast market changes more rapidly and accurately than conventional approaches.

Moreover, AI and ML are increasingly handling routine activities in the venture capital process, like the preliminary assessment of investment opportunities and tracking market trends. This shift allows human resources to focus more on crafting strategies and managing relationships with investors.

Blockchain Technology and Smart Contracts

Blockchain technology is revolutionizing how we handle transparency and efficiency in financial deals, particularly in the venture capital industry. Smart contracts automate these processes, providing a secure and unchangeable method of agreement. This eliminates the need for middlemen, cuts costs, and reduces the chances of conflict.

Moreover, blockchain provides a permanent record of transactions, which builds trust between investors and startups alike. Furthermore, its decentralized nature safeguards against data manipulation or fraud to boost investment security, while its rapid transaction times reduce processing periods for clearing and settlement which used to take days.

Remote Investment Strategies

Technological advances have allowed venture capitalists to operate internationally without needing to be physically present. Remote communication tools and collaboration platforms let VCs connect with startups and manage business activities across different continents and time zones. This global reach not only diversifies investment portfolios but also opens doors to new markets and innovative ideas, greatly expanding the potential of venture capital investments.

Additionally, these technologies help scale operations without increasing costs, making international investments more practical. Improved data sharing ensures that remote investments are monitored with the same diligence as local ones, maintaining investment quality and compliance.

Impact on Investor-Startup Relationships

Technology significantly changes how investors and entrepreneurs interact. Digital tools make communication faster and support systems more organized, allowing venture capitalists to provide ongoing advice and resources to their startups. This constant involvement helps VCs track progress and performance in real time, offering timely guidance and adjustments that are essential during a startup's early stages.

Virtual meeting platforms and project management tools improve the frequency and quality of communication, ensuring startups get the mentorship they need to overcome initial obstacles. Additionally, technology helps gather and analyze detailed performance data, enabling VCs to customize their support and interventions based on specific metrics and goals.

Final Thoughts

Integrating technology into venture capital management is transforming the sector significantly. Venture capitalists, by utilizing digital resources and data analytics, are enhancing their operational effectiveness and making more informed investment decisions.

As this shift persists, venture capitalists need to adjust and progress to remain relevant in an environment that is becoming more influenced by technological advances. The outlook for venture capital is optimistic, with these technological advancements setting the stage for more adaptable, effective, and prosperous investment approaches.

Copyright © . All Rights Reserved