Balancing Aesthetics and Functionality in Trading Software Development

Trading software serves as the critical interface between traders and the complex web of global exchanges. As the demand for sophisticated trading platform development services continues to grow, developers face a unique challenge: striking the perfect balance between aesthetics and functionality.

This delicate equilibrium is essential for creating tools that not only perform flawlessly but also provide an engaging and intuitive user experience.

What Are The Trader's Needs?

At the heart of every successful trading platform lies a deep understanding of the end-user's requirements. Traders, whether novice or experienced, share some common needs that should guide the development process:

Speed and Efficiency Requirements

In the world of trading, milliseconds can make the difference between profit and loss. High- performance trading software must:

- Execute orders with minimal latency

- Update market data in real-time

- Provide quick access to essential functions

Developers must optimize every aspect of the software to meet these demanding speed requirements without compromising on reliability or user experience.

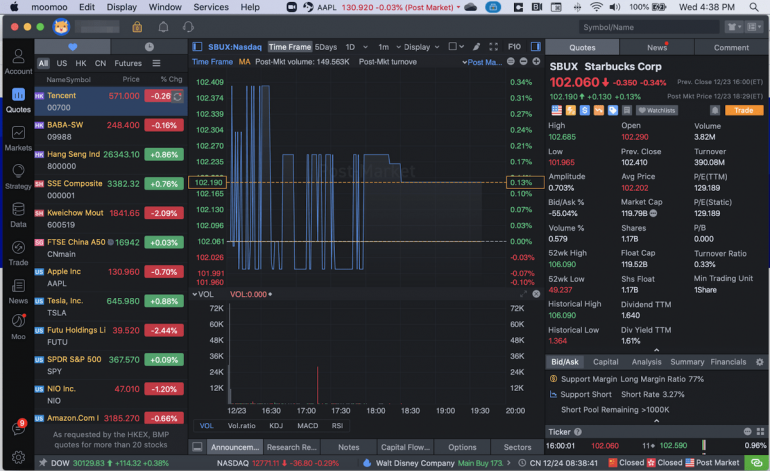

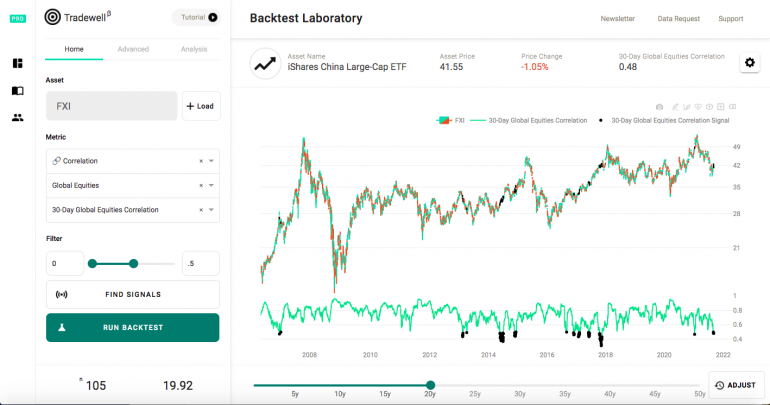

Data Visualization and Analysis Tools

Traders rely heavily on their ability to interpret vast amounts of market data quickly. Effective trading platforms should offer:

- Clear and customizable charts

- Real-time indicators and overlays

- Advanced technical analysis tools

By presenting complex data in visually appealing and easily digestible formats, platforms can enhance a trader's decision-making process.

Customization and Personalization Preferences

No two traders are alike, and their software should reflect this diversity. Key customization features include:

- Adjustable layouts and workspaces

- Personalized watchlists and alerts

- Customizable hotkeys and shortcuts

Allowing users to tailor the platform to their unique trading style not only improves efficiency but also increases user satisfaction and loyalty.

The Power of Aesthetics in Trading Platforms

While functionality is paramount, the aesthetic appeal of a trading platform plays a crucial role in its adoption and continued use.

Reducing Cognitive Load Through Design

A well-designed interface can significantly reduce the mental effort required to operate the software, allowing traders to focus on market analysis and decision-making. This can be achieved through:

- Clean, uncluttered layouts

- Intuitive icon design and placement

- Consistent use of color and typography

By minimizing distractions and enhancing visual clarity, traders can process information more efficiently, leading to better performance.

Color Psychology in Financial Interfaces

Colors evoke emotional responses and can influence decision-making. In trading software, strategic use of color can:

- Highlight important information (e.g., green for positive changes, red for negative)

- Create a sense of calm or urgency when appropriate

- Improve readability and reduce eye strain during long trading sessions

Developers should carefully consider the psychological impact of their color choices to create an environment conducive to focused trading.

Branding and Differentiation in a Competitive Market

In a crowded marketplace, a visually distinctive platform can set itself apart from competitors. Strong branding in trading software can:

- Foster trust and credibility with users

- Create a memorable user experience

- Align with the target audience's expectations and preferences

By developing a unique visual identity, trading platforms can build brand loyalty and attract new users in a highly competitive industry.

Functionality: The Core of Trading Software

While aesthetics play a crucial role, the core functionality of trading software remains its most critical aspect. Developers must ensure that the platform delivers on several key fronts:

Real-time Data Processing and Display

The lifeblood of any trading platform is its ability to handle and present real-time market data. This involves:

- Efficient data streaming and processing

- Low-latency updates across all parts of the interface

- Scalable architecture to handle high volumes of data

Ensuring that traders have access to the most up-to-date information is crucial for making informed decisions in volatile markets.

Order Execution and Management Systems

The ability to execute trades quickly and accurately is fundamental. A robust order management system should include:

- One-click trading capabilities

- Advanced order types and algorithms

- Clear order status updates and trade confirmations

These features empower traders to implement their strategies effectively and manage their positions with precision.

Risk Management and Compliance Features

In today's highly regulated financial markets, trading software must incorporate robust risk management and compliance tools. Key features include:

- Real-time risk calculation and exposure monitoring

- Customizable risk limits and alerts

- Audit trails for regulatory reporting

By integrating these features seamlessly into the platform, developers can help traders stay compliant while managing their risk effectively.

Achieving Balance: Design Principles for Trading Software

To create a truly exceptional trading platform, developers must skillfully blend aesthetics and functionality. Here are some key principles to guide this process:

Minimalism and Clarity in UI Design

The old adage "less is more" holds particularly true in trading software design. A minimalist approach can:

- Reduce visual clutter and cognitive overload

- Highlight critical information and actions

- Improve overall system performance

By carefully curating the elements displayed on the screen, developers can create a more focused and efficient trading environment.

Intuitive Navigation and Workflow Optimization

A well-designed trading platform should feel natural and intuitive to use. This can be achieved through:

- Logical grouping of related functions

- Consistent placement of key elements across different screens

- Clear visual hierarchies to guide user attention

Optimizing the user's workflow can significantly reduce the learning curve and improve overall trading efficiency.

Scalability and Responsiveness Across Devices

Modern traders expect to access their platforms from various devices. To meet this need, developers should focus on:

- Responsive design that adapts to different screen sizes

- Consistent functionality across desktop and mobile versions

- Synchronization of settings and preferences across devices

By providing a seamless experience across platforms, trading software can accommodate the diverse needs of today's mobile-first users.

Overcoming Common Challenges

Balancing aesthetics and functionality in trading software development comes with its share of challenges. Here are some common obstacles and strategies to overcome them:

Information Overload and Data Presentation

Challenge: Presenting vast amounts of market data without overwhelming the user.

Solution:

- Implement customizable dashboards

- Use progressive disclosure techniques

- Provide data visualization options (e.g., heat maps, treemaps)

Balancing Advanced Features with Ease of Use

Challenge: Incorporating sophisticated trading tools without complicating the user interface.

Solution:

- Offer tiered interfaces for different user skill levels

- Use tooltips and in-app tutorials for complex features

- Provide customizable workspaces to hide unused features

Adapting to Diverse User Skill Levels

Challenge: Creating a platform that caters to both novice and experienced traders.

Solution:

- Implement a modular design with optional advanced features

- Offer personalized onboarding experiences

- Provide extensive documentation and learning resources

The Future of Trading Software Design

As technology continues to evolve, so too will the design and functionality of trading platforms. Some emerging trends to watch include:

AI-Driven Interfaces and Predictive Analytics

Artificial intelligence is poised to revolutionize trading software by:

- Providing personalized insights and recommendations

- Automating routine tasks and analysis

- Enhancing risk management through predictive modeling

Integration of Social Trading Features

Social trading elements can enhance the user experience by:

- Allowing traders to follow and learn from successful peers

- Facilitating the sharing of trading ideas and strategies

- Creating a sense of community within the platform

By staying ahead of these trends, developers can ensure that their trading software remains relevant and competitive in an ever-changing financial landscape.

Copyright © . All Rights Reserved